Amid the economic catastrophe caused by COVID-19, distilling spirits has always seemed like one industry that was well-positioned to weather the storm. Retail sales of liquor increased dramatically in the early days of the pandemic, a trend that was widely reported under headlines such as “Booze Sales Are Booming” or our very own “Americans Are Drinking More of (Almost) Everything During Coronavirus.”

The popular perception is that consumers have compensated for lost bar and restaurant sales by purchasing more liquor to drink at home. While there’s some truth to that, aggregate statistics obscure the fact that the gains have not been evenly distributed. Established liquor brands are reaping the benefits of increased retail sales, but craft distillers are getting crushed.

According to the market research firm Nielsen, off-premise sales of liquor in the United States are up about 30 percent year-over-year for the pandemic period. Despite this massive growth, sales revenue for craft distilleries is expected to decline by more than $700 million in 2020, representing about 40% of sales in that sector. That projection comes from a survey of nearly 300 American distilleries conducted by the Distilled Spirits Council of the United States (DISCUS) and the American Distilling Institute. Craft distillers are missing out on the boom in sales because the pandemic hasn’t just shifted consumption from the bar to the home; it’s also changed how consumers buy liquor in ways that favor big companies over small competitors.

“People are drinking, but they’re not shopping,” explains Tom Burkleaux, owner and distiller at New Deal Distillery in Portland, Oregon, and vice president of the Oregon Distillers Guild. That doesn’t mean consumers aren’t buying liquor, of course, they’re just not exploring as much as they did before the pandemic. “They’re sticking with the familiar.”

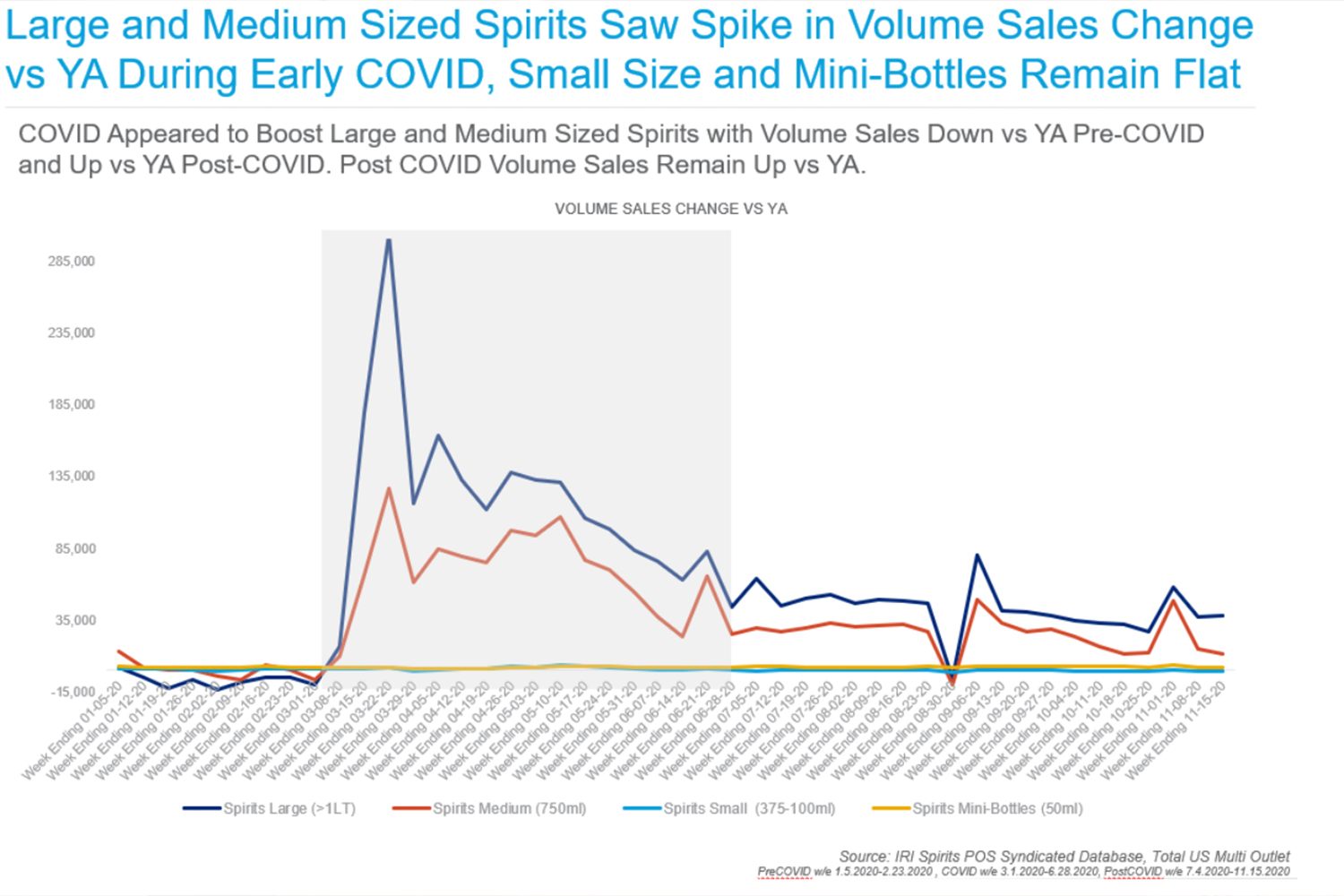

A striking illustration of this appears in sales statistics for larger volume bottles (1 liter or larger) in the early days of the pandemic. Data provided by the market research firm IRI reveals that these enjoyed a massive spike in sales, rising more than 80% over the same period in 2019. This was part of a trend that saw consumers stocking up on all kinds of alcohol in larger formats: 1.75-liter handles of liquor, boxes of wine and 24- or 30-packs of beer.

DISCUS

Unfortunately, this buying bonanza for large-format liquor would have done little to benefit craft distillers, most of whom package their spirits in the more typical 750ml bottle. Larger handles are generally reserved for mass-produced budget brands or established brands with name recognition and consumer loyalty.

Sales of large-format and 750ml bottles came into closer alignment as the pandemic wore on, but craft distillers remain at a disadvantage. “The big brands are doing well because people know what Jack Daniels or Tanqueray tastes like,” says Aaron Bergh, president and distiller at Calwise Spirits in Paso Robles, California. “We can’t do in-store tastings anymore because of COVID, and that’s definitely hurt us.”

Persuading consumers to try an unfamiliar spirit is an inherent challenge of being a craft distiller, but the COVID-related closure of tasting rooms and cocktail bars has made that task especially difficult. On routine trips to liquor stores, consumers tend to purchase spirits they already like; they discover what they like through tasting. Distillery visits, recommendations from bartenders, and in-store sampling are key avenues for small brands to reach new consumers. With all three restricted or completely shut down, craft spirits are at a distinct disadvantage in the marketplace.

“My major thing is getting to do a tasting and people taking a bottle home,” says Bergh. “For about half the year, people haven’t actually been able to come in to do a tasting. They can buy a bottle, but they can’t taste it first. That can be a tough pill to swallow for a lesser-known craft distillery that they’re not familiar with.”

The inability to offer tastings also narrows the variety of spirits that consumers are buying. “Gin and vodka are back,” says Tom Burkleaux of New Deal, who adds that whiskey is selling well, too. But the pandemic has made it much harder for craft distillers to sell their more niche spirits, such as his Cascadia Liqueur, a bitter liqueur flavored with gentian, angelica root, flowers and other botanicals. It’s a quality spirit, but it’s not the kind of thing consumers are likely to seek out without having tried it first. “Cascadia has definitely gone down a lot. Obscure has gone down for sure,” says Burkleaux. “People are doing easy drinking at home.”

This shrinking variety extends to bars and restaurants, too. When they’re open at all, they’ve tended to simplify their menus and pare down their selections, a necessity given capacity restrictions and the current uncertainties of the industry. “We did a lot of business with craft cocktail bars,” says Bergh. “That’s pretty much gone away because they haven’t been able to open. If they are open, they’ve cut their budgets. They’re not putting craft liquor in the cocktails anymore. I can’t blame them. They’re business owners, too, but it’s had a negative impact on craft distillers who have a higher price point with their spirits.”

The loss of tourism has been another devastating blow to craft distilleries. Many small distilleries sell their spirits in only one or a few states, but in ordinary years they can reach a much wider range of consumers via tourism. Paso Robles promotes its Distillery Trail, for example, and Portland has its Distillery Row. These tasting room sales tend to provide higher margins for distilleries since they are made directly to consumers. According to Burkleaux, tourism provided about half of the business for some Portland tasting rooms. Those customers are gone.

“I’ve been hearing so much, ‘People are drinking a lot in the pandemic, you must be fine,’” says Bergh. The reality is that the closure of tasting rooms, loss of tourism, and changing buying patterns in bars and liquor stores are taking a tremendous toll on the craft side of the industry. In the DISCUS survey of distilleries, more than half of respondents reported declines in their on-site sales of 25% or more, with similar results for wholesale sales.

To make matters worse, craft distillers also face political obstacles unrelated to COVID. The European Union imposed a 25% tariff on American whiskey in 2018 and announced new tariffs on American rum, vodka, brandy and vermouth in November. According to Chris Swonger, president of DISCUS, American whiskey exports to Europe are down 41% compared to their pre-pandemic, pre-tariff levels. “We’ve seen examples of craft distillers investing a lot of time and effort to build up the marketplace in Europe, and they’ve stood down over the past two years because of the tariffs,” says Swonger.

And then there are taxes. In 2017, Congress passed the Craft Beverage Modernization and Reform Act, which substantially reduced the rate of excise taxes paid by craft distillers. It reduced taxes on the first 100,000 gallons of spirits a distiller produces to $2.70 per gallon, down from the previous standard of $13.50 per gallon. The reduced rates were not implemented permanently, however, and Congress has yet to reauthorize them for 2021. That leaves distillers facing a very uncertain future.

Such a dramatic increase in taxes would be burdensome in any year, but it would be especially so following a year as uniquely difficult as 2020. “Unless Congress reauthorizes, distillers will face a 400% tax increase,” says Swonger. “If we fail to get that passed through Congress by year-end, it will be devastating.” Passage of the tax cut has been far from certain despite bipartisan support, but Congress appears poised to finally make it permanent.

Amid all this doom and gloom, there have been a few bright spots for craft distillers. Many states have legalized cocktails to-go or liberalized restrictions on online delivery and direct shipping. “The government getting out of the way and getting rid of these cumbersome laws has been good for us,” notes Bergh, although there are still challenges advertising alcohol on digital platforms.

Skip Tognetti, owner of Letterpress Distilling in Seattle, Washington, has managed to pull off a slight increase in revenue, thanks to purchases from devoted regulars and “a little bit of luck and a little ingenuity.” Although his wholesale spirits sales are down, he was able to supplement the business first with sanitizer production early in the year, then by purchasing 4-ounce glass bottles in bulk and selling them to local bars and restaurants for their cocktails to-go. “I know what it’s like to try to source packaging when you have a million things going on,” he says. The bars get a great price on the bottles, and the modest revenue helps even out some of his lost spirits sales. Six months in, he’s now on his seventh pallet of tiny bottles.

Still, none of this is sufficient to make up for the industry-wide losses imposed by the pandemic. As this difficult year comes to a close, fans of craft distilling can help out by adding an adventurous bottle from a local craft distillery to their last-minute holiday shopping list. The gift will be appreciated by the recipient, and no doubt by the distiller who produced it, too.

"craft" - Google News

December 22, 2020 at 06:00PM

https://ift.tt/3aFAkox

COVID-19 Is Killing America's Small Craft Distilleries - InsideHook

"craft" - Google News

https://ift.tt/2YrY2MS

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "COVID-19 Is Killing America's Small Craft Distilleries - InsideHook"

Post a Comment