A version of this story first appeared in CNN Business' Before the Bell newsletter. Not a subscriber? You can sign up right here.

Volkswagen (VLKAF) and General Motors (GM) employ hundreds of thousands of workers and operate huge factories on multiple continents. They rely on complicated supply chains to source parts, and they sell their products through brick-and-mortar dealership networks.

But investors are starting to treat these lumbering industrial giants more like nimble startups as they make heavy investments into electric cars and autonomous driving that could pay huge dividends.

The numbers: Shares in General Motors, which is spending $35 billion on electric vehicles by 2025, have skyrocketed over the past year, rising nearly 140%. Ford's stock has also increased 140% over the same time period.

Volkswagen shares are up 50% over the past year. Europe's largest carmaker is putting €35 billion ($42 billion) into electric vehicles over five years. It plans to open six battery-making "gigafactories" in Europe by 2030.

Investors have long viewed electric-car pioneer Tesla (TSLA) as a technology company, and its stock price has been supported by continued superiority in battery costs, software and the profitability of its electric cars.

But bigger automakers including General Motors are starting to be seen in a similar light as they commit to building battery factories.

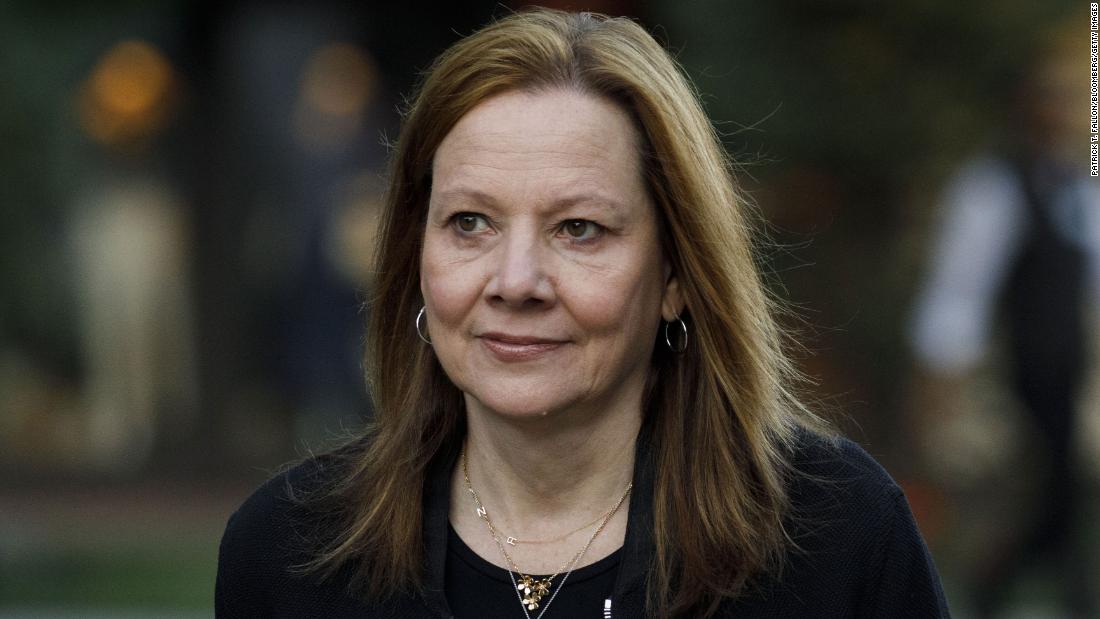

Dan Ives, an analyst at Wedbush Securities, said on Thursday that General Motors shares should be worth $85 a piece, a 52% increase from current levels. Why? Because CEO Mary Barra is all-in on electric cars.

"While the first part of her tenure had some clear lows and major speed bumps, the laser focus on electric vehicles has given new energy and strategic focus to GM," Ives wrote in a research note.

He said the company's share price should continue to rise as "the Street treats the Detroit automaker no longer as a traditional auto company trading based on book value, but a broader disruptive technology play that can start to trade at multiples similar to the likes of Tesla."

If you're the CEO of an automaker, the thing to do now is to announce a big investment in electric vehicles and watch your share price go up.

Right on cue: Stellantis, the giant automaker formed by the merger of Fiat Chrysler and France's PSA, said Thursday it plans to invest €30 billion ($35.5 billion) by the end of 2025 to expand its portfolio of electrified vehicles.

The company is planning for 70% of its sales in Europe and 40% of sales in the US to be either fully electric or plug-in hybrid (but with a large majority of those vehicles being fully electric) within four years, CEO Carlos Tavares said.

"[The plan] is among the most aggressive electric vehicle commitments the industry has yet seen," said Karl Brauer, an industry analyst with ISeeCars.com.

Investors, meanwhile, need to figure out which of these electric dreams will turn into reality. One factor to consider is that the biggest carmakers (General Motors and Volkswagen belong to this group) will be able to use the profits from their massive existing businesses to invest in electric vehicles.

Their smaller electric rivals might not be able to keep pace.

Fear suddenly grips Wall Street

Global stocks tumbled Thursday as investors grew fearful that the global economic rebound could be slowing.

In the United States, The Dow closed down 0.8%, or 260 points, while the S&P 500 dropped 0.9%. The Nasdaq Composite fell 0.7%. All three indexes had suffered much steeper falls earlier in the day.

Investors continued to pour money into the safety of US government bonds, sending yields to a five-month low. At 1.25%, the 10-year Treasury yield hasn't been this low since February. That's down significantly from its 52-week high of 1.77% set in March, as inflation fears were running rampant.

Franziska Palmas, a markets economist at Capital Economics, said the retreat from risky assets could be attributed to growing evidence that shortages are holding back economic growth in the United States, signs that growth in China is slowing and the continued spread of the Delta variant.

Where do we go from here? Palmas said that with expectations from strong economic growth already priced into markets, she sees "little scope for risky assets to continue to make large gains over the next few years."

But at the same time, she doesn't expect stocks to drop sharply. That's because central banks will continue to provide huge amounts of support to the economy, and the recovery is likely to continue at a rapid pace.

"Taking all of this together, we still expect equities generally to make some more ground between now and the end of 2023, but suspect that gains will be much smaller than over the past year or so," she said.

Restaurant workers are quitting in droves

Restaurant workers are calling it quits just as people are starting to dine out again and restaurants rush to reopen, reports my CNN Business colleague Danielle Wiener-Bronner.

In May, the rate of quits per share of employment in the accommodation and food services sector, which includes restaurants, was 5.7%, according to seasonally adjusted data released this week by the Bureau of Labor Statistics. That figure held steady from the month prior, and is higher than the quit rate across all sectors, which fell from 2.8% in April to 2.5% in May.

Restaurant workers have had a challenging time during the pandemic. Servers in particular put themselves at risk of contracting Covid-19 by interacting with customers. On top of that, they had to police customers who pushed back on mask or social distancing policies.

"People had to actually work harder to show that they were friendly and welcoming, despite the fact that their smile was covered up by a mask," said Alicia Ann Grandey, a psychology professor at Penn State who specializes in labor issues. "Trying to put on that friendly demeanor, even in the face of work stress and hostile customers, is linked to turnover," she added.

With a high rate of employees quitting, more could follow, according to those who study labor relations, perpetuating the high rates. To keep them on board, restaurants may have to improve what they offer.

US wholesale inventories data will be published at 10:00 a.m. ET.

Coming next week: US inflation data for June. Plus, retail sales.

"now" - Google News

July 09, 2021 at 06:28PM

https://ift.tt/2TSDwab

Automakers are tech companies now - CNN

"now" - Google News

https://ift.tt/35sfxPY

Bagikan Berita Ini

0 Response to "Automakers are tech companies now - CNN"

Post a Comment