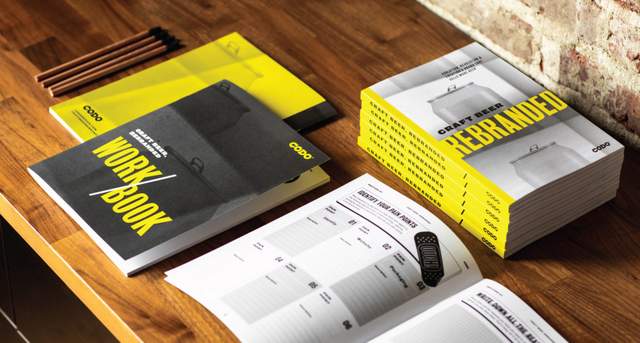

This column was provided by CODO Design, a food and beverage branding firm, and authors of Craft Beer, Rebranded. This book (and companion workbook) is a step-by-step guide to help you map out a successful strategy for rebranding your brewery. If you’d like to discuss your brewery’s branding, shoot Isaac an email anytime: [email protected]

Hi there. This is an excerpt from a 9,000+ word piece that was originally published on CODO Design’s site. Read the rest of the 2020 Craft Beer Branding Trends review over there: https://cododesign.com/2020-beer-branding-trends/

::::::

A word cloud, but it just says “Hard Seltzer”

Let’s get this one out of the way now

I’m tired of hearing about White Claw. I don’t have anything against hard seltzer, or the people who drink it, but it’s just — I get it. Hard seltzer is here to stay. It’s not a trend, but a category in and of itself. Etc.

Will it slow down at some point? Yes. But if the big players in the market are any indication, there will be several more years of freight train growth before it levels off. CODO can’t add too much to this conversation because it’s been dissected and written about by every major business and brewing industry outlet ad nauseam for the last few years.

What we will say is that if you’re considering releasing a seltzer, you should consider the brand architecture ramifications of this move within your portfolio. Should it fall under your brewery’s parent brand and live alongside your beer as another offering? Or, should it take on its own brand name, styling and positioning to flourish without the risk of gutting your primary positioning (as, you know, a craft brewery)? Whatever you do, be sure that your identity as a brewery remains intact no matter which direction the product goes.

Micro trend within this trend:

IRI and industry reports are saying there’s a lot of room for growth in this category, and we’re seeing small and big craft alike launch lines. We think the real opportunity here is for larger (or even smaller, though firmly established) consumer packaged goods (CPG) brands (whether traditionally alcoholic or non-alcoholic) to launch extensions and leverage significant equity and distribution — think Topo Chico, La Croix (shocked this hasn’t already happened) and Faygo (even more shocked that this hasn’t happened. whoop whoop.) to quickly carve out a piece of the market. Yes, you’ll never beat Truly or White Claw, but being sixth in a $2.5 billion market isn’t the end of the world.

Major brewery rebrands

Staying top of mind and competitive

There are now 8,000 breweries open in the United States, a majority of them with a few years under their belt, and there are thousands more in-planning, slated to open over the next few years.

With this much competition, it’s not just that shelf space or coolers are crowded — they are. Or that landing a consistent spot on a tap list is hard — it is. It’s that there are so many options available to beer drinkers that what used to be nice-to-haves have become have-to-haves — compelling branding and beautiful packaging topping this list (shortly after dependable, quality beer).

As a branding firm working heavily in the beer space, we’re on the front lines of what’s happening as breweries reach out to enlist our help (canaries in a coal mine, if you will). And somewhere between 2017 and 2018, seemingly overnight, the brewery branding inquiries we were receiving shifted from breweries-in-planning to established breweries looking to rebrand. We’ve worked with folks who have been at it for nearly 30 years all the way down to breweries who have been open for just a year or two. 2020 shows no sign of this slowing with news of craft stalwarts like Oskar Blues, Left Hand, Ska Brewing and Ale Smith all announcing major brand refreshes.

It’s a little early to call 2020 the year of the rebrand (and we think the next several years will be full of high profile ones — including a few huge ones that we can’t speak about just yet…), but we think you are going to start seeing hundreds of breweries refresh their story, identities, positioning and packaging over the next few years in a bid to stay relevant and competitive.

Shameless plug from your friends at CODO: We believe that rebranding is such a competitive advantage that we’ve spent the last year writing our new book bundle, Craft Beer, Rebranded, to help breweries navigate this process. If you are even remotely considering an update, your team should check this out.

Growing non-alc

Another round of Synthehol for the table?

We first started seeing N/A beers pop up last year. Now, there are major entrants in the category, from large craft to the upper reaches of Big Beer. My unscientific take — I have a hunch that the Millennial cohort that drove the explosive growth of the craft beer category over the last 10 years is feeling the collective strain of that effort: fatty livers, not always being mentally present (particularly bad if you’ve got a growing family) and the magic line that was crossed when we turned 30 and hangovers became preternaturally painful. We’re growing up and, while we love craft beer, can’t justifiably drink it four to seven days a week like we did in our twenties. Moderation may be in order here, but there is something to be said for the idea that N/A beers allow you to indulge without such deleterious effects.

Non-alcoholic beers will never replace traditional beer, but there are a lot of indicators that this is moving beyond fad status. As many as one in five adults (a staggering figure) have reported giving Dry January a shot. The “Better For You” beer category continues its rise, and you could even argue that hard seltzer is a sign of today’s beer consumers being more mindful of the alcohol and calories they consume (which is funny, because most of the leading hard seltzer brands actually have a similar ABV as a typical macro beer, but they have the perception of being lower alcohol because of the lighter taste profile).

Better For You marches on

Beer’s healthy now. What a time to be alive.

The Low Cal and Lite trend rose to prominence last year and is seemingly becoming a category unto itself. Bumping up against the rise of hard seltzers and the (fantastic) resurgence of expertly-made, quaffable lagers, startup breweries, established regional breweries and Big Craft alike are all jumping on this bandwagon. What’s interesting is that they’re not just offering “Lite” American lagers, but positioning them along the lines of the big American macros — you know, the “weak,” “tasteless” and “the like having sex in a canoe” ones the industry has spent the last 20 years deriding.

Health-mindedness has spread beyond lagers to include IPAs and various other traditionally craft styles in a lower-cal format. Among these, we’re still seeing the interesting categorical differentiation plays with terms like “Recovery Beer,” “Functional Beer” and even the ambitious moniker of “Wellness Beer.”

Micro trends within this trend

1. It seems like 100 calories (or in that neighborhood) is the benchmark for this space, whether you’re making a “light” beer or a seltzer.

2. Watch for more breweries to start canning these offerings in 12-oz sleek cans to better connote that it’s a healthier option. This is also good for a lifestyle positioning play.

3. “Better For You” beers lend themselves to lifestyle positioning — beer for runners, ultra marathoners, mountain climbing, cycling, CrossFit and so forth. It’s also perfectly positioned for those who like to slap aces all day with their boring neighbors.

Experience as differentiator

Your taproom as an immersive brand experience

We’ve seen an uptick in breweries focusing on improving their customer experience itself (service, staff training, professional development, cicerone training, furniture, design, music, ambiance) over the last year. It’s been fun for us as we get to work on more interior design, murals, wayshowing, merch programs and menus.

People don’t have to go to a brewery to enjoy beer. They can drink it at home while watching Netflix. So you need to give them a reason to come in. This can manifest in traditional and more contemporary programming — beer and food pairings, new beer releases, live music, a family-friendly venue, goat yoga, pig yoga and yoga-yoga.

Assuming you make great beer, your taproom ambiance can be a huge differentiator. More than simply getting people through your doors to buy higher margin draft beer, you’re grounding customers in an immersive, tangible experience. This carries over to off-premise. Now, someone who can pick from hundreds of breweries on shelf has a memory to pull from and a reason to buy your beer. They were there. They drank your beer there, interacted with your staff and other customers there and (hopefully) had fun there. These types of experiences can cement a strong and lasting relationship.

Vintage IP

Presto! Instant provenance.

This trend started years ago with the reemergence of PBR and High Life, and has seen more development recently with Hamms, Ranier and Narragganset (stuff you’d drink while fishing with grandpa). On the smaller craft side, we’ve seen fun programs across the country where a brewery obtains Intellectual Property (IP) for a defunct (usually pre-, or just post-prohibition) beer brand and faithfully reproduces it, branding and all.

This works because it brings an instant story to the table. It’s an opportunity to lean into all that real authenticity and history to create a connection with customers. And from a portfolio and product mix standpoint, it can also create a strong one-off brand to help bolster sales.

Brewery franchising

Two McBeers, please.

As the market continues to mature and more breweries focus on taproom sales to bolster profits, franchising becomes a logical tangential model. It combines the “Hub and Spoke” concept (flagship brewery that sells through to its satellite taprooms) with a decentralized management opportunity. Plus, there are a lot of people who have wanted to get into craft beer for a long time but haven’t been able to ditch their former career, or lacked the know how, funding or confidence to completely do it on their own.

And if that’s not enough, we’ve been approached by five different franchises (in-planning) over the last year. We think that’s enough to call this a trend (or at least, an impending one).

Branding = sales

That’s cool. Will it help us sell more beer?

In our first seven or so years of working with breweries, most of our project goals revolved around long term brand building. We were tasked with defining a brewery’s differentiator and creating beautiful branding and packaging to tell that story. We would then, half jokingly, take credit for big increases in YOY sales that almost always occurred after the project.

Now that industry growth is slowing, it’s become apparent that these big jumps in sales weren’t any great feat on our part. Or, you could even argue, the brewery’s itself. The last 10 years of craft beer (excluding maybe the last two), have seen astronomical growth. Assuming a base level of quality, beer would sell itself. And while branding was, and will always be important, it served as jet fuel for an already fast moving rocket ship of sales and expansion.

Now when a brewery partners with us for a rebrand, they often come to the table with the very specific goal of selling more beer. Yes, we want to build our brand, and yes, we want to further enmesh ourselves in the community, and foster an amazing culture, (and brew amazing beer), but this project, this branding project, is being carried out with the express purpose of selling more beer. Full stop.

This has lead to a shift in our strategy and thinking. We’re always concerned with brand building because you need to understand the lore and stories upon which the entire business is built before making any sort of impact. But now, we’re spending just as much time working with field marketing teams, sales teams, distributors and chain retailers as part of our brand strategy work.

This is a stark difference from five years ago, and we think this shift in conversation — this renewed focus on measuring every single aspect of a branding project — is one more indicator of how tight the market has become.

Catch you on the “Innovation Pipeline”

Evolving from a brewery to a “beverage company”

We’ve worked within the “Innovation Pipeline” of several global CPG beverage companies over the last few years. In one of these instances, we were in a board room with their marketing and product development team literally creating a matrix of popular beverage categories to see what could be combined and hybridized for market testing (no one liked my “smoked brisket seltzer” idea, if any VC’s are reading this). We’ve been privy to a few of these explorations in larger craft breweries over the last year as well as folks shuffle to gird their portfolios against declining beer sales with anything they can dream up.

There’s this self-imposed (or perhaps market-imposed?) arms race to find the next hard seltzer with companies rolling out hard coffees, harder kombucha (this is the next big thing, after seltzer’s shine wears off, FYI), non-alcoholic offerings, RTD canned cocktails, cannabis-infused this and CBD-infused that.

Does this say anything about the current state of the craft beer industry? If anything, it brings up an interesting conversation around what it means to be a craft brewery. When the largest craft breweries in the country are selling more seltzer than beer, or are introducing hopped water and RTD canned cocktails, or are opening coffee bars and juiceries, what does that mean for the smaller breweries? If the goal posts are constantly being moved, and the idea of “craft” is always being redefined to keep people on our team, then who’s to cast judgement on a brewery who can — or has to — do whatever they need to to stay viable?

::::::

Read the rest of this piece over at: https://cododesign.com/2020-beer-branding-trends/

Snapshot: We review the last decade of beer branding and name the most pervasive and staying trends of the era. Then, we dive into what we’re seeing just beyond the visual front to talk about broader industry trends. And finally, we’ve reached out to industry experts at all 3 tiers and from around the world for their take on what’s happening today.

Craft Beer, Rebranded (and its companion workbook) are a step-by-step guide to help you map out a successful strategy for rebranding your brewery. Based on CODO Design‘s decade of brewery branding experience, this book will help you weigh your brand equity, develop your brand strategy and breathe new life into your brand. Whether your brewery is three years old or 30, Craft Beer, Rebranded is your guide to attracting new audiences, selling more beer and positioning your brand for the long haul.

Read and buy it now at: www.craftbeerrebranded.com

"craft" - Google News

May 26, 2020 at 11:03PM

https://ift.tt/36Axxca

2020 craft beer branding trends Part 2: 'Major Industry Trends' - Craft Brewing Business

"craft" - Google News

https://ift.tt/2YrY2MS

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "2020 craft beer branding trends Part 2: 'Major Industry Trends' - Craft Brewing Business"

Post a Comment